News at a glance

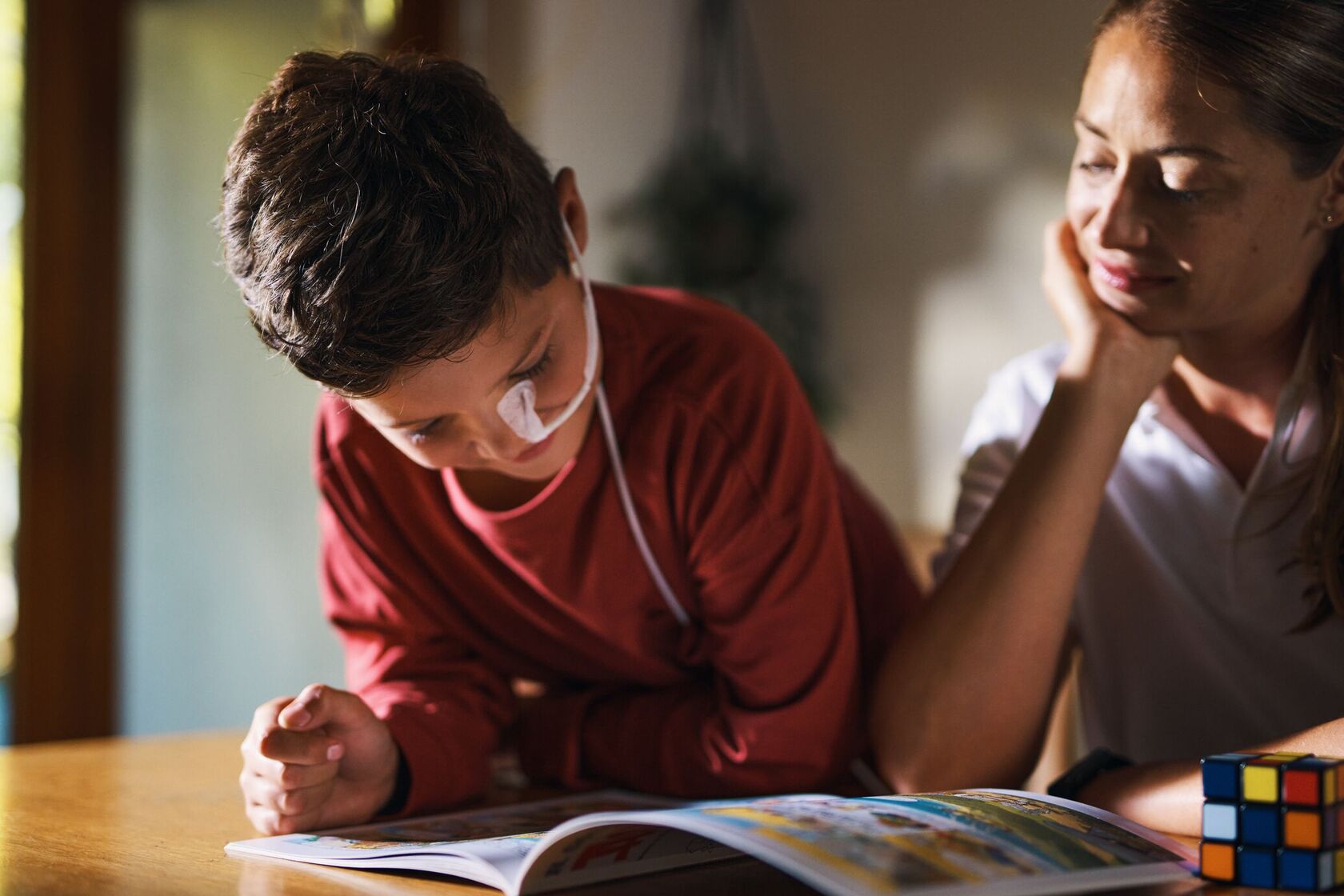

Hybrid healthcare services – a key element of tomorrow’s healthcare

What will healthcare look like in the future? This question is of concern not only to the Federal Council as part of its “Health2030” strategy, but also to universities, health insurers – and us as the leading network in the Swiss healthcare market.

HomeCare Bichsel and Lifestage Solutions: Working together for unique home care services

Galenica offers a unique range of services for retirement and nursing homes and home care organisations, hospitals and medical practices throughout Switzerland. These include the fully automated ordering and billing of consumables and care products via Lifestage Solutions as well as Bichsel’s specialised home care services. Our goal as a network: Significantly relieve the burden on nursing staff through digital solutions and specialist expertise.

New internal appointment of General Counsel and Secretary General

Barbara Wälchli, General Counsel and Secretary General, has decided to leave Galenica at the end of 2025. With Cécile Matter as the new General Counsel and Jürg Pauli as the future Secretary General of the Board of Directors, two experienced executives from within the company are taking over the reins.

Galenica and the invisible work behind safe medications

What does it take to ensure that only safe and effective medications reach people in Switzerland? Galenica ensures that quality standards are met – from the place of manufacture all the way to the pharmacy or hospital. In this story, you’ll find out exactly how this works and what it has to do with underfloor heating.

Yves Platel is the new President of the Association of Pharmacists of the Canton of Zurich

A pharmacist from the Galenica network assumes responsibility at association level: Yves Platel, Co-Managing Director of the Amavita pharmacy at Zurich Railway Station, was elected President of the Association of Pharmacists of Zurich (AKVZ) on 19 June 2025.

Committed together – how we support social projects

Twice a year, our employees have the opportunity to cast their vote and determine the proportion of donations for social projects on the crowddonating platform “there for you”. The first round of voting in 2025 was recently completed. With our support, one of the projects directly reached the donation target.

Between conveyor belts and barcode scanners: a self-experiment in the logistics centre

What happens when an office worker dives into the world of logistics? A communications employee put it to the test and spent an evening in the Galexis logistics centre, surrounded by buzzing forklifts and countless blue boxes.

More responsibility for pharmacies in providing care from 2027

The revision of the Health Insurance Act (HIA) strengthens the position of pharmacies as important players in the healthcare system. The development of the around 380 pharmacies in the Galenica network shows how investments in training, infrastructure and digital solutions are already paying off today.

The pharmacy is becoming the first point of contact for health issues

With long waiting times for GPs and overcrowded emergency departments, many people are looking for faster access to medical assistance. Pharmacies are playing an increasingly important role in this. Galenica shows how pharmacies can meaningfully relieve strain on our healthcare system.

Shaping tomorrow's healthcare system together.

Our latest videos

Information for investors

Invest in the strongest network in the Swiss healthcare market.

Here you will find information about our share price, as well as presentations, conferences and our financial calendar.